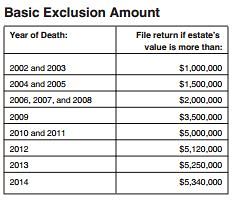

Many Revocable Living Trusts contain what is called a Credit Shelter Trust. This was very common when the unified credit amount was low ($675,000 in 2000 and 2001 and $1 Million in 2002 and 2003). The problem with this is that these Credit Shelter Trusts force a Trustee on the first spouse’s death to fund the Credit Shelter Trust with the maximum amount of the unified credit. This was done in order to save Estate Taxes on estates that were worth more than $675,000 to $1 Million. This “formula” for funding the Credit Shelter Trust means the surviving spouse will end up with fewer assets to live on for their lifetime. This is not the intended outcome but could be the outcome unless it is corrected. The unified credit amount in 2017 was $5.49 Million. The Tax Bill passed in December 2018 raised that amount to $11.2 Million. Arizona does not have a State Estate Tax. Therefore, unless your gross estate is worth more than $11.2 Million there is likely no need for a Credit Shelter Trust and by not correcting it, it will force your Trustee to fund the Credit Shelter Trust with up to $11.2 Million from your estate and the remainder will go to your surviving spouse’s Trust. This could have the unintended consequence of leaving your spouse without enough money to live on.

Many Revocable Living Trusts contain what is called a Credit Shelter Trust. This was very common when the unified credit amount was low ($675,000 in 2000 and 2001 and $1 Million in 2002 and 2003). The problem with this is that these Credit Shelter Trusts force a Trustee on the first spouse’s death to fund the Credit Shelter Trust with the maximum amount of the unified credit. This was done in order to save Estate Taxes on estates that were worth more than $675,000 to $1 Million. This “formula” for funding the Credit Shelter Trust means the surviving spouse will end up with fewer assets to live on for their lifetime. This is not the intended outcome but could be the outcome unless it is corrected. The unified credit amount in 2017 was $5.49 Million. The Tax Bill passed in December 2018 raised that amount to $11.2 Million. Arizona does not have a State Estate Tax. Therefore, unless your gross estate is worth more than $11.2 Million there is likely no need for a Credit Shelter Trust and by not correcting it, it will force your Trustee to fund the Credit Shelter Trust with up to $11.2 Million from your estate and the remainder will go to your surviving spouse’s Trust. This could have the unintended consequence of leaving your spouse without enough money to live on.

We offer a consultation to review your current Trust to see if you have a Credit Shelter Trust built into your current Trust and can help you correct it if you do. The charge for this consultation is $500.